Investing in Art: A 7-Step Guide for New Art Collectors

Art WiseWhen it comes to investing our money, we all seek the most interesting and lucrative options. Over the years, the world of investing has truly diversified, with high net worth individuals investing in alternative asset classes like fine wines, rare coins and art. With art investment growing in popularity and accessibility, the number of art collectors in India and around the world has seen a steady rise.

(Source: Pexels)

(Source: Pexels)

If you are considering investing in art or becoming a serious art collector, it’s important to take the right steps before you embark on this path. Here are 7 tips from Artisera to ensure that your journey as an art collector is off to a smooth start:

1. Learn About the Trade

When investing in any new asset class, it is important to understand the industry as a whole – market trends, how it functions, what impacts it and what the latest developments are. Reading about art is critical, whether it is by following the news and thought leaders on social media, or subscribing to blogs and art magazines. A must do for anyone starting their journey of collecting, is to frequently attend art exhibitions at galleries as well as shows at museums. Attending art fairs is also crucial, as you get to see a huge variety of art from several galleries, in one place. The India Art Fair in New Delhi, India Art Festival in Mumbai and the Kochi Biennale are examples of large-scale art exhibitions that take place in India.

India Art Fair 2018 (Source: artdose.in)

India Art Fair 2018 (Source: artdose.in)

Exposing yourself to a wide range of artforms such as paintings, installations, prints, sculptures, photography as well as traditional and tribal art, can help deepen your knowledge, and allow you to develop your own sensibilities. A great way to gain continuous exposure is to browse curated online art galleries. Following auctions in India as well as globally is also an interesting way to understand what is happening in the art market, and learn about the movers and shakers in the trade.

2. Network with Experts

Interacting with experienced art collectors, curators, professional art consultants, gallery owners and artists can help aspiring and emerging collectors make more informed decisions. Conversing with experts can increase your knowledge about the trade as well as open up varied perspectives of looking at art itself. The best way to meet and network with experts is to frequent art fairs, exhibitions, talks and other art events that are visited by enthusiasts.

(Source: Pexels)

(Source: Pexels)

3. Learn about the Artist

A significant part of your pre-purchase research should be about the artist. Consider different factors like whether the artist is emerging or established, or if they are self-taught or formally educated in the arts. Learn about their artistic journey, and distinctive styles they have experimented with. An artist’s participation in solo shows and group exhibitions is an indication of how established they already are. If their works are part of important private and public collections, or have been displayed at a museum, it’s a sign of being more established. Any awards the artist has won, art camps or residencies they have been invited to or participated in, also give you important insight into the journey and promise that an artist holds. If you are looking to invest in an artist who is already very senior and well-established, it might be worth checking if they have featured in auctions and how they performed there.

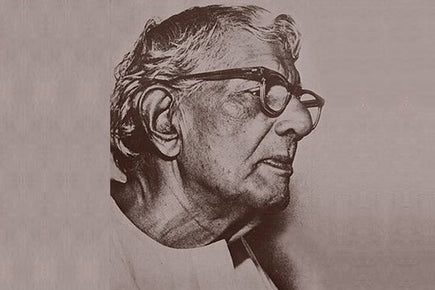

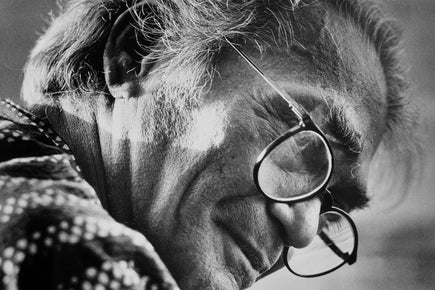

Acclaimed Indian modern artist, S.H. Raza

Acclaimed Indian modern artist, S.H. Raza

4. Create a Balanced Portfolio

While building your collection, it is important to balance your portfolio and hedge your bets. Spreading capital across multiple artists and different art forms is wise, as not every piece of art might accrue in value. A diversified collection can help hedge your investments and add variety to your collection.

5. Back Emotion with Research

Awareness is monumental while investing in art, but it is equally important to have fun building your collection and truly love the pieces you pick. Try to strike a balance between emotionally connecting with an artwork and backing it up with information-led decision making. A combination of research and instinct will help you find a middle ground, allowing you to buy pieces you really love, that are also good investments.

(Source: Pexels)

(Source: Pexels)

6. Plan for a Growing Collection

As you build your collection of high-value art, practicalities like maintenance, insurance and storage come into the picture. With a growing collection, planning is key, and one must be mindful of how to care for their art in the best possible way. The art world is price-heavy, and collectors must ensure that the art they have kept on display or in storage is maintained with utmost care to preserve its value. Emerging collectors should be mindful of the additional costs of maintenance, storage and insurance, while deciding how and when to grow their collection.

7. Have the Right Psyche

Art is a long-term investment, and it is judicious for collectors to have the right mindset while investing in it. Patience is an indispensable quality to have as an art collector, as you cannot expect overnight returns. While the art market may not be as volatile as traditional asset classes, it is certainly not immune to economic fluctuations, and does get affected by economic slowdowns. So, it is important to be prepared for any impact that national or global economic trends might have on the art industry.

For most collectors, art is a passion and window into the world and its cultural bounty. With the process of investing in art becoming smoother and more transparent than ever before, there has never been a better time to embark on your journey as a collector. As investment in art grows, one is also witnessing interesting innovations in the sector. One such innovation is art investment funds, which allow individuals to invest in art with guidance from a professional team. While the concept is quite popular in developed art markets, it is still in its nascent stages in India. But with the Indian art market growing and becoming more organized, it may not be long until art funds become prominent, making the investment ecosystem all the more interesting.